SAS in

Numbers

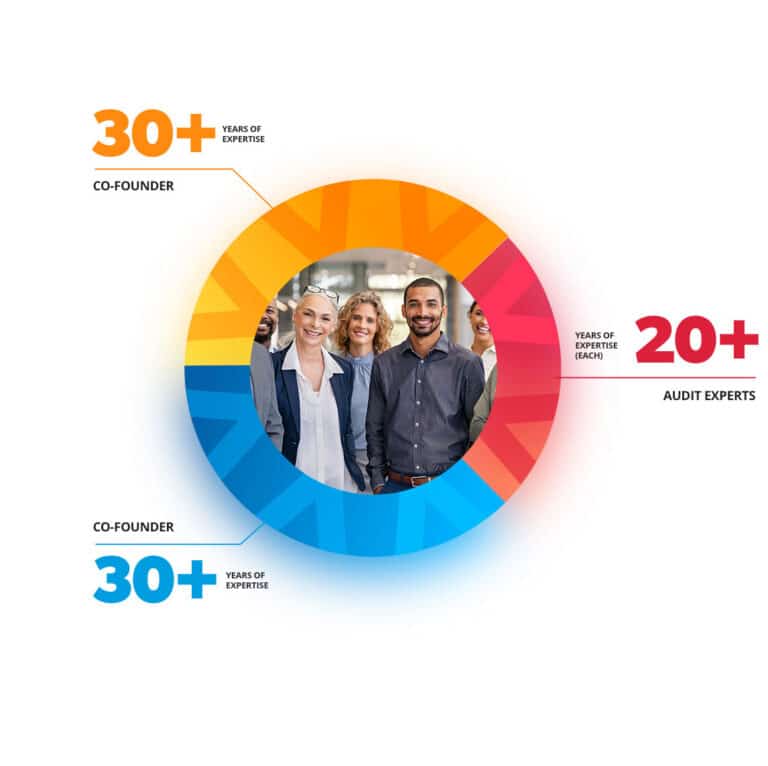

Decades of Audit and Industry Experience to Your Project

Our co-founders oversee every project led by senior level auditors. Our team has audited many of America’s largest companies including more than 50% of the Fortune 100. As pioneers in the AP Recovery Audit Industry, we developed many of the best practices and processes still in use today.

As thought leaders, we continue to develop new approaches to identifying additional recovery opportunities for our clients.

Empower Your Team with AP Audit and Recovery Software

Access the Vault where you can level up your organization’s ability to audit, track, and recover profit using your talented professionals and our proven digital technology software.

See what our clients say...

SAS Insights

Revolutionizing Accounts Payable: The Rise of AP Audit Tools in the Next Generation of Recovery Auditing

The Accounts Payable (AP) Recovery Audit industry emerged decades ago to address over-payments, over-charges, and accounting errors in medium and large-sized companies. Due to the high volume of transactions, companies […]

Continue Reading

Maximizing Financial Health: The Crucial Role of AP Recovery Audits for Healthcare Supply Chain Leaders

In the intricate world of healthcare supply chains, where precision and reliability are paramount, the Accounts Payable (AP) process plays a critical role. One often underestimated strategy for enhancing supplier […]

Continue Reading

Unveiling Efficiency: Exploring AP Audit Objectives for Financial Excellence

Over the last three decades, Accounts Payable (AP) Recovery Audits have been a widely known best practice for medium to large size organizations. Depending on the environment, organization and unique […]

Continue Reading

Strategic Audit Solutions, Inc. Proudly Announces Employee of the Year 2023 – Larry Crawley

Larry Crawley, who recently assumed the role of Chief Technology Officer, has been an invaluable asset to SAS throughout his remarkable 10-year career with the company. His dedication and outstanding […]

Continue Reading