When shopping for a firm to provide Accounts Payable Recovery Audit services, all too often many organizations treat that practice as though they were buying a commodity. Some organizations believe there is little differentiation between a service coming from one supplier and the same service from another supplier. Quite often, the Procurement group drives the sourcing process of an Accounts Payable Recovery Audit. They are tasked with obtaining the lowest price without having the proper understanding of service differentiation between providers and can make the mistake that the lowest rate drives the best value. The terms ‘commodities’ and ‘services’ are often used interchangeably but failing to understand the difference between them can result in a poor and costly business decision.

A Service or a Commodity?

A commodity is a generic name given for a product which is common and cannot be differentiated. By definition, “a service is a means of delivering value to customers by facilitating outcomes customers want to achieve without the ownership of specific costs and risks.” Consider the example of gold. In its basic form, gold will be priced the same and is not differentiable. It is therefore a commodity. Accounts Payable Recovery Audits, on the other hand, are a service and like most services, are distinctly different between different providers.

Of course, it is prudent for an organization to get the best price for the service offered. However, understanding the differentiation between providers is extremely important. In most cases, the firm offering the lowest rate is not the best financial decision.

If the rate is too low, the audit firm:

- May not have broad capabilities

- Might use inexperienced auditors

- Might only go after the low hanging fruit to save costs (i.e. duplicate payments, open vendor credits)

Not All Audits Are Created Equal

In doing so, they may miss the more significant opportunities that are in other areas which require greater skills, time, and resources.

Accounts Payable Recovery Audit services are typically provided on a contingency fee basis. The value received is not as obvious as other fee based services because the client is unaware of the potential recoveries left unidentified.

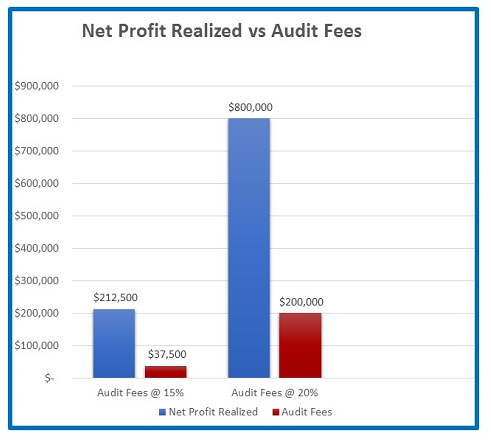

Take for example a billion dollar company that hires an AP Recovery firm with limited capabilities. The firm offers a low contingency rate of 15% and recovers $250,000. This results in a contingency fee of $37,500 with a net profit realized of $212,500.

If the audit was done by a firm with greater capabilities delivering a thorough audit, it is reasonable to expect recoveries to reach $1,000,000. If the rate that firm offers is 20%, the contingency fee would be $200,000 with a net profit realized of $800,000.

That is a 277% increase in net profit realized!

In this example the old adage “you get what you pay for” certainly holds true. Clearly the better decision is to go with the firm with broader capabilities.

Minding the Intangible

There are many other intangible elements to consider in the decision making process when selecting an Accounts Payable Recovery Audit firm. Will the firm:

- Provide actionable information to allow you to fix the problems avoiding future profit loss

- Provide educational training to your staff to mitigate future risk

- Operate in a professional, unobtrusive manner

- Respect your relationship with your suppliers

- Create good, well documented claims housed in a web based client portal

In conclusion, selecting the right Accounts Payable Recovery Audit firm for your project should not fall into a decision making process that assesses a service as a commodity buy. The project should be viewed as a financial solution, having a multi-faceted impact on your bottom line.

When choosing your audit partner, simply keep in mind that you truly do “get what you pay for”.

Contact SAS to gain the maximum benefits and recovery on your next project.

SAS Insights

Strategic Audit Solutions Launches AuditSUITE360 Platform as Demand for Accounts Payable Recovery Technology Surges

Enterprise-grade financial recovery technology delivers 90% efficiency gains in automated cost control Freehold, NJ – May 1, 2025 – Strategic Audit Solutions, a leader in accounts payable recovery audit technology, […]

Continue Reading

The SaaS Revolution- Your Recovery Audit Secret Weapon

The SaaS Revolution: Your Recovery Audit Secret Weapon Let’s be honest, cloud migration isn’t exactly breaking news. But you know what is? The explosive growth of SaaS adoption. Reports1 indicate […]

Continue Reading

AP Recovery Audits- The Essential Guide to Protecting Your Bottom Line

AP Recovery Audits- The Essential Guide to Protecting Your Bottom Line Organizations process millions of transactions annually. Amid this volume, errors are inevitable. Whether it’s duplicate payments, missed credits, or […]

Continue Reading

The Importance of Maintaining a Clean Vendor Master File

The Importance of Maintaining a Clean Vendor Master File The vendor master file is a cornerstone of accounts payable operations and plays a crucial role in maintaining financial integrity and […]

Continue Reading